How Long Does Bankruptcy Stay on Your Credit Report?

The Duration of Bankruptcy

on Credit Reports

Bankruptcy is a significant financial decision that millions of Americans face every year. Financial hardships can cause us to be unable to meet our financial obligations such as credit card debt, student loans, medical bills, rent, and other living expenses. Bankruptcy is an option to help reduce or eliminate certain financial obligations. However, this can affect your credit report. In this blog post, we will explore how bankruptcy affects your credit report and how long it stays on your credit report.

How Does Bankruptcy Affect Your Credit Report?

Bankruptcy is a significant event that impacts your credit score and report. It is a negative event that causes your credit score to be significantly lower and your credit report will reflect that you filed for bankruptcy. This will make it challenging to apply for and get loans and credit cards.

How Long Does Bankruptcy

Stay on Your Credit Report?

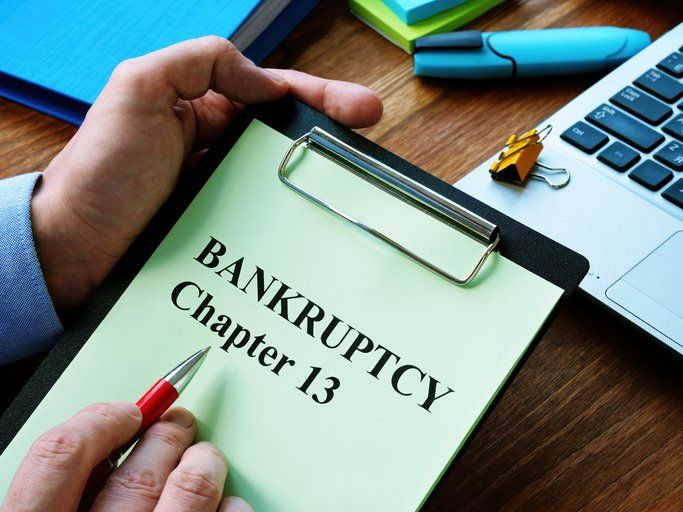

The duration of how long bankruptcy is reflected on your credit report will depend on the type of bankruptcy you file for. Here are the general guidelines for each type of bankruptcy:

Chapter 7 Bankruptcy: This type of bankruptcy, also known as liquidation bankruptcy, typically stays on your credit report for ten years from the date of filing. During this period, lenders and creditors will see the bankruptcy notation when reviewing your credit history.

Chapter 13 Bankruptcy: Chapter 13 bankruptcy, also known as reorganization bankruptcy, involves creating a repayment plan to pay off debts over a specified period. It typically remains on your credit report for seven years from the date of filing.

Learn More from Our Bankruptcy Attorney Today!

Bankruptcy is not an easy decision to make. However, it is necessary for people who are experiencing financial hardship and are struggling to meet their financial obligations. Navigating the bankruptcy process can be challenging to go through too. Our bankruptcy attorney is here to help individuals throughout Buffalo, NY navigate that process. We will help you gather documents, file bankruptcy forms, and negotiate with creditors. This will help you achieve financial freedom from debilitating debt. Contact us today to get started filing for bankruptcy!