How Long Does Foreclosure Take?

Learn More About the Foreclosure Timeline With Our Local Lawyers

Foreclosure is not a situation that anyone wants to be in. Unfortunately, our financial circumstances change, and we become unable to pay our mortgage or taxes. It is a common occurrence that many homeowners experience. You can quickly become overwhelmed with the many thoughts that cross your mind when faced with foreclosure. One of the most common questions that homeowners have is: “How long does foreclosure take?” The answer is it depends.

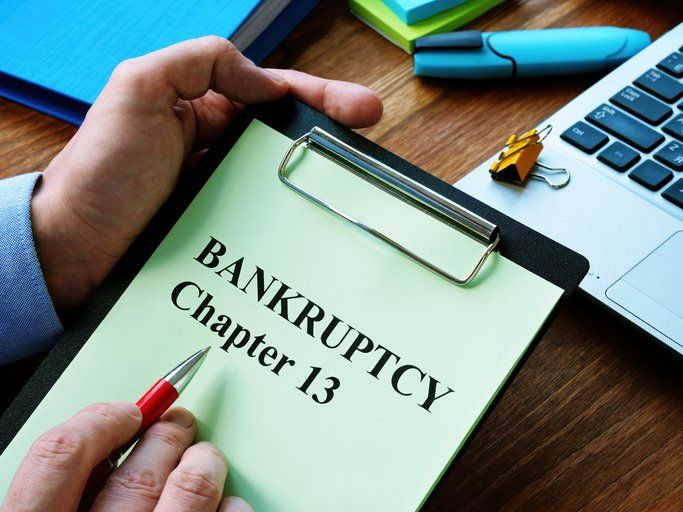

In theory, it takes 6-8 months for a foreclosure to move from complaint to auction. However, this is hardly the case. It often takes much longer. If you file an answer and appear at the mandatory settlement conference, it will take 1 to 3 years to foreclose. So, you have time to learn all the facts and the options available to you. You should consult with your foreclosure lawyer upon notice of foreclosure. Do not panic and take the time to do your research and make the decision that is best for you.

Contact Our Experienced Foreclosure Attorney Today

The Law Office of Wendy J. Christophersen is a foreclosure attorney serving the Buffalo, NY area. When you hire our attorney, they will help you explore your options for keeping your home and avoiding foreclosure. You will retain ownership of your property throughout the entire foreclosure process. You are free to refinance, sell, or file bankruptcy. Hiring a lawyer is always a great idea because beyond providing you with your legal options, we can represent you in mediation or court, and file all necessary legal documents on your behalf. Contact us today to schedule your initial consultation!