Things to Consider Before Filing Bankruptcy

Everything You Need To Know Before Filing

Bankruptcy

Filing for bankruptcy is a significant decision that can have long-lasting effects on your financial life. At the Law Office of Wendy J. Christopherson in Buffalo, NY, we understand the complexities and emotional weight of this decision. Here’s a comprehensive guide to help you navigate the process and make an informed choice.

Chapter 7 Bankruptcy vs. Chapter 13 Bankruptcy

Chapter 7 Bankruptcy

- Overview: Chapter 7 bankruptcy, also known as liquidation bankruptcy, is designed to help individuals eliminate most of their unsecured debts, such as credit card debt and medical bills.

- Process: In a Chapter 7 bankruptcy, a trustee is appointed to liquidate non-exempt assets to pay off creditors. Once the process is complete, the remaining debts are discharged.

- Eligibility: To qualify for Chapter 7, you must pass a means test, which evaluates your income and expenses to determine if you can afford to repay your debts.

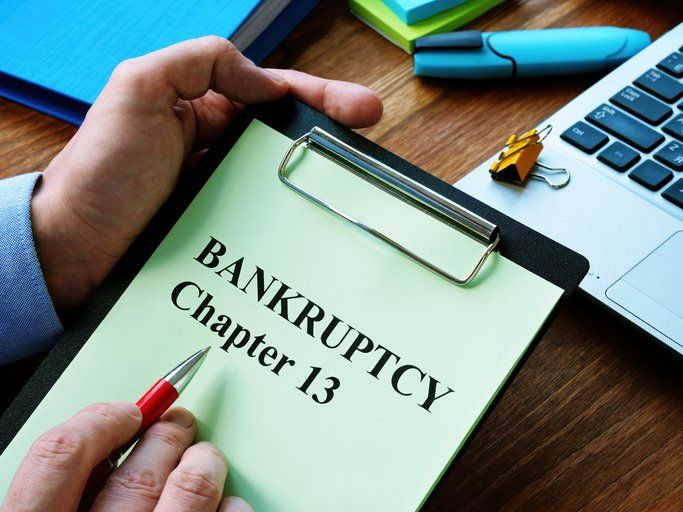

Chapter 13 Bankruptcy

- Overview: Chapter 13 bankruptcy, also known as reorganization bankruptcy, allows individuals to keep their property and pay off debts over a period of three to five years.

- Process: You will work with a bankruptcy attorney to create a repayment plan that is approved by the court. During this period, you make regular payments to a trustee, who distributes the funds to your creditors.

- Eligibility: Chapter 13 is typically for individuals with a regular income who can afford to make monthly payments.

What to Know Before Filing Bankruptcy

- Financial Assessment

- Debt Analysis: Understand the types of debts you have, including secured and unsecured debts. Some debts, like student loans and child support, are generally not dischargeable.

- Budget Review: Evaluate your income and expenses to determine if bankruptcy is the best option. Consider alternatives like debt consolidation or negotiation with creditors.

- Credit Impact

- Credit Score: Filing for bankruptcy can significantly lower your credit score and remain on your credit report for up to 10 years. However, it can also provide a fresh start and the opportunity to rebuild your credit over time.

- Legal Assistance

- Bankruptcy Attorney: Consulting with a bankruptcy attorney is crucial. They can help you understand the legal implications, prepare your paperwork, and represent you in court.

- Costs: The bankruptcy cost can vary, including filing fees, attorney fees, and credit counseling fees. Ensure you have a clear understanding of these costs before proceeding.

What Happens After Filing Bankruptcy

- Automatic Stay

- Protection: Once you file for bankruptcy, an automatic stay goes into effect, halting most collection activities, including wage garnishments, foreclosures, and lawsuits.

- Debt Discharge

- Chapter 7: Most unsecured debts are discharged, allowing you to start fresh.

- Chapter 13: After completing the repayment plan, remaining unsecured debts are discharged.

- Rebuilding Credit

- Steps to Take: After bankruptcy, focus on rebuilding your credit. This includes paying bills on time, keeping credit card balances low, and maintaining a stable employment history.

Ready to Take the Next Step?

Filing for bankruptcy is a significant decision, and having the right guidance is essential. At the Law Office of Wendy J. Christopherson, we are dedicated to helping you navigate the bankruptcy process and achieve financial stability. Call us at (716) 852-7373 or visit our office in Buffalo, NY, to schedule a consultation with a bankruptcy lawyer. We are here to support you every step of the way.