Why Should I Hire a Bankruptcy Attorney?

Benefits of Hiring a Bankruptcy Attorney

If you are considering a bankruptcy claim, it goes without saying that funds are tight. Hiring a bankruptcy attorney might seem like an unnecessary expense, especially because you have the right to file without using an attorney. However, there are a number of reasons why it might be a better idea to consult an experienced professional. If you’re on the fence about whether to work with a bankruptcy attorney on your case, we have compiled several ways that a bankruptcy attorney can help you as you make your decision.

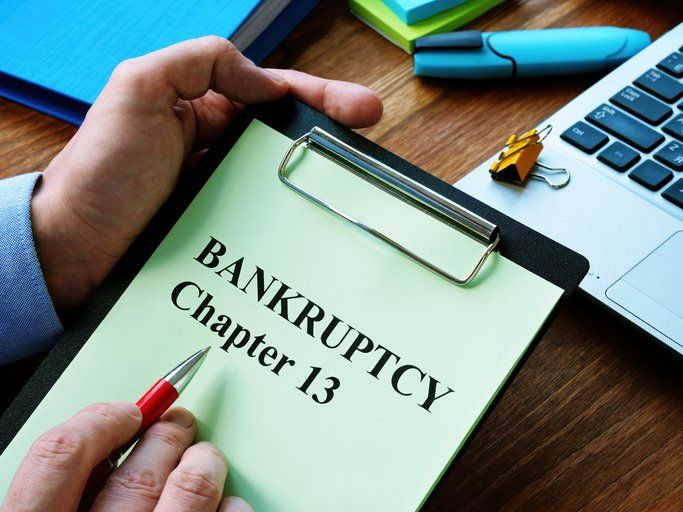

Professional Planning and Guidance

The bankruptcy process can be complex. There are multiple types of bankruptcy; the type you file for will depend on your circumstances and qualifications. An attorney can help you through the process from beginning to end, from the preliminary planning stage to ensuring that all paperwork is filed correctly and on time. They will also be available to answer any questions you might have about the process, which can help you feel less isolated and contribute to peace of mind. Finally, a bankruptcy lawyer can help if there are any changes to your circumstances during your case.

Ensuring Your Testimony is Complete and Accurate

When you file for bankruptcy, you will need to submit accurate and up-to-date information for your case to be considered. You must sign all paperwork under penalty of perjury, so it’s important to submit truthful information. A bankruptcy lawyer will ensure that all of the information you provide is correct.

Negotiating With Creditors

During the bankruptcy process, you’ll need someone in your corner to deal with creditors. A bankruptcy lawyer can negotiate with creditors if there are any assets you want to keep (such as an automobile). They can also deal with any creditors who attempt to collect any payments during this time. Having someone with experience working on your behalf can make this process much easier and encourage all parties to negotiate in good faith. You are also more likely to see a successful outcome.

Post-Bankruptcy Assistance

After your case goes through the process, a bankruptcy attorney can help you make the most of your fresh start. This includes resolving post-bankruptcy violations if a creditor attempts to collect a debt that was wiped out; a lawyer can also provide guidance on how to rebuild your credit. There will be offers and opportunities available to you at this point; an experienced professional can help point you to the ones that will prove the most beneficial.